The Social Security Administration (SSA) has announced a 2025 COLA increase of 2.5%, marking the smallest annual adjustment since 2021. As inflation rates have moderated from their pandemic-era peaks, this modest bump in benefits has raised concerns among advocates for older Americans, who argue that it may not sufficiently address their financial needs.

Table of Contents

ToggleWhat the 2.5% COLA Increase Means

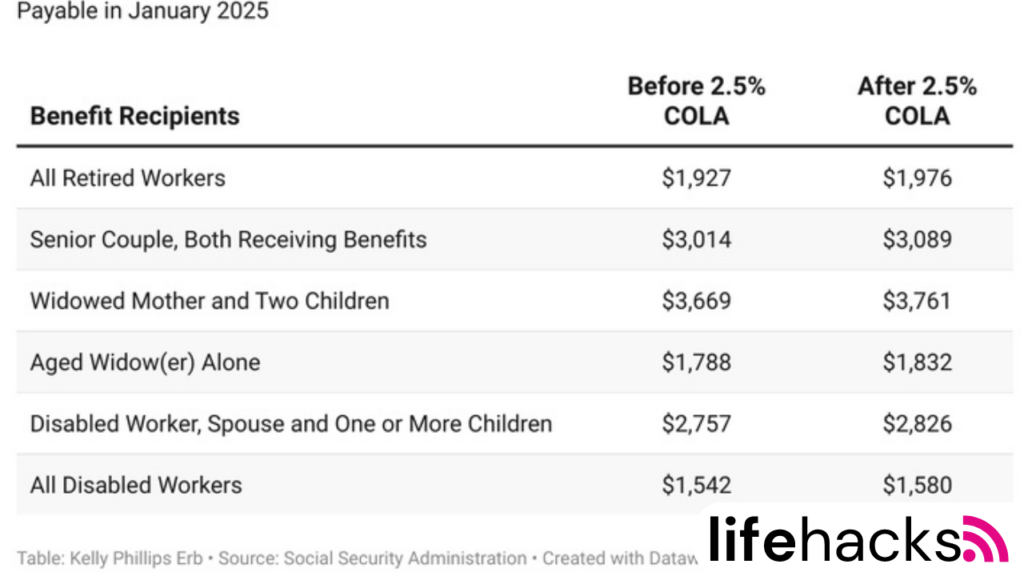

The average monthly Social Security benefit payment will rise by almost $50 beginning in January 2025. For the 68 million Social Security beneficiaries who will see the new amounts appear in their benefit checks, this adjustment is especially important. Currently, retirees receive an average monthly pension of roughly $1,927. That amount will grow to $1,976 with the latest hike. The average monthly payout for married couples receiving Social Security will rise from $3,014 to $3,089 per month.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which monitors price fluctuations for a particular basket of goods and services, is the basis for calculating the COLA. Even if inflation has decreased since June 2022, many seniors believe that their increased healthcare costs—which are further eating away at their purchasing power—have not been adequately reflected in the changes.

Concerns About the COLA Increase

Many seniors would argue that this is insufficient to keep up with rising costs “As stated by AARP Senior Vice President of Government Affairs Bill Sweeney. Due to persistent inflationary pressures, Social Security is often the sole source of income for elderly individuals. As such, the 2.5% rise may not be sufficient to cover their daily needs.

For example, it is anticipated that the monthly regular Medicare Part B premium will increase from $174.70 in 2024 to $185 in 2025. For many retirees, this increase may lessen their actual benefit rise. The way the calculations are now done does not fully account for the particular costs that older Americans incur, especially when it comes to living and healthcare bills.

Payment Schedule for the COLA Increase

Recipients will begin receiving the 2025 COLA in their January benefits, with payment dates determined by birth month:

- Birth dates between the 1st and 10th : Payments on January 8

- Birth dates between the 11th and 20th : Payments on January 15

- Birth dates between the 21st and 31st : Payments on January 22

For individuals who began collecting Social Security before May 1997 or those who also receive Supplemental Security Income (SSI), the COLA increase will be reflected in their January 3 payment. SSI recipients will see their adjusted payments starting December 31, 2024.

An Overview of Recent COLA Adjustments

| Year | COLA Percentage |

|---|---|

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

| Note: According to the Senior Citizens League, the purchasing power of Social Security benefits has declined by approximately 20% over the past 14 years. | |

Also Read More : Apparent Trump Assassination Attempt: Key Details and Updates

The Need for a More Accurate COLA Calculation

Senior advocates contend that the Consumer Price Index for Elderly Consumers (CPI-E), a separate measure that more accurately captures the purchasing patterns and expenses experienced by people 62 and older, should serve as the foundation for the COLA. The head of Social Security Works, Nancy Altman, highlights that the particular financial difficulties faced by older Americans are not taken into consideration by the present COLA calculation.

The anticipated rise, according to 82-year-old Florida retiree Sherri Myers, “won’t make a dent” in her daily spending. She is even thinking about going back to work to augment her income, which consists of her Social Security benefits and a little pension, as inflation is eating away at her savings.

Conclusion

For many retirees, the 2.5% COLA rise in 2025 is a crucial adjustment that will provide a slight increase in their monthly payments in the face of volatile inflation. Concerns about its adequacy, however, draw attention to the continued difficulties elders have in preserving their spending power. It is evident that many supporters are pushing for changes that more fairly represent the financial realities faced by older Americans as conversations on the suitability of the current COLA formula continue.

It is still crucial to keep knowledgeable about changes and how they affect specific financial situations as Social Security claimants get ready for the changes that will take effect in January 2025. Recognizing the intricacies of Social Security and pushing for enhancements helps guarantee that the program keeps providing essential assistance to individuals who depend on it.